Disclaimer: This is not a stock pick. I do have a long position, but I'm writing this to provide a more realistic and comprehensive explanation of what AppLovin's business actually does. I also understand there have been recent short-seller reports about the company, which I will reference below. This isn't a puff piece on why I think $APP is a buy. Please understand that.

On another day that the markets are confused — rightfully so — it seems like $APP is showing a sign of how the stock may react in the days to come if we get some kind of bounce back in the stock market. This stock could look like the alpha in your portfolio and may be comfortable living above a $100b market cap. Based on both fundamentals and market psychology, the chart of $APP may be telling investors that we're not just another ad tech stock — we are disruptors and a great example of how AI can explode margin expansions.

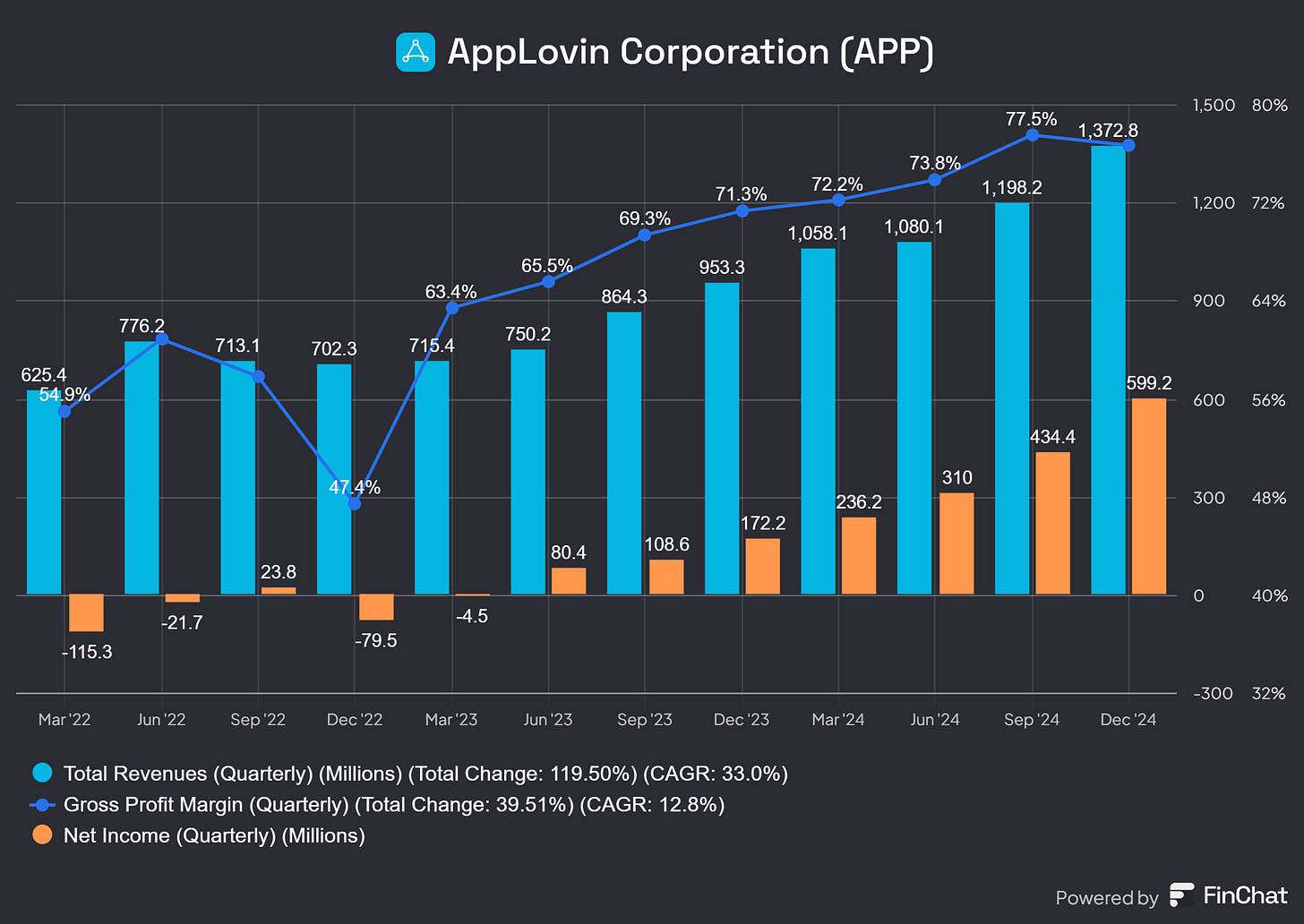

I've been watching APP carefully ever since I took a position during this market sell-off and am still fully wrapping my head around their business model. It's obviously an expensive stock, but at the same time, it has healthy financials — which is rare for a $80b market cap (previously trading above $100b before this market sell off).

What AppLovin Actually Does

AppLovin sits at the center of a two-sided ad marketplace:

🟣 On the supply side:

App publishers — mostly mobile game developers — use AppLovin’s tools (like the MAX mediation platform) to monetize their apps. They auction off in-app ad space, and AppLovin ensures they get the highest yield per impression.

🟡 On the demand side:

Advertisers — including app creators, gaming companies, and increasingly, non-gaming brands — use AppLovin’s DSP (AXON) to bid in real time for ad placements across that inventory.

The advertiser pays only when a user engages, installs, or converts. The publisher gets paid. And AppLovin keeps a take rate — all powered by real-time bidding, behavioral prediction, and optimization.

It’s the engine behind a large slice of the mobile advertising world — and it’s mostly invisible to consumers.

Where Do These Ads Actually Show Up?

You’re playing a mobile game like Royal Match or Merge Dragons. You finish a level and get an offer:

“Watch a video to earn coins.”

You tap. A 15–30 second video ad plays — maybe for another game, or increasingly, a product or service.

✅ That ad was served by AppLovin.

✅ It was shown because AXON’s AI believed you’d engage.

✅ The advertiser bid to be in that moment — and paid if it worked.

This is where AppLovin excels: full-screen, rewarded video ads shown in highly engaging mobile environments, with performance-based pricing and AI-driven targeting.

The AI Engine That Drives It: AXON

The beating heart of AppLovin is AXON, its proprietary AI model. AXON determines:

Which ad to show to which user

What bid to place in the auction

How to optimize for ROAS (Return on Ad Spend)

It learns constantly from over 1 billion daily active users across AppLovin’s partner apps. It doesn’t just make recommendations — it acts autonomously, in milliseconds.

This is how AppLovin achieves:

78% EBITDA margins in advertising

$3M in adjusted EBITDA per employee (run rate)

Over $2.1 billion in annual free cash flow — which they used mostly on share buybacks

They’re not hiring massive teams to chase revenue. They’re letting AI scale the business while staying lean.

AppLovin’s Clients: Who’s Spending the Money?

AppLovin’s primary advertising clients are:

Mobile game developers acquiring users

App creators looking to drive installs

Subscription apps or services promoting in-app conversions

Emerging non-gaming verticals, such as ecommerce, fintech, news, or health & wellness

AppLovin doesn’t name client’s (to my knowledge), but their earnings call confirmed that even with a small pilot group, their models are already delivering results across non-gaming categories. And they’re now investing in self-serve tools to open the floodgates to millions of advertisers globally.

Expansion Ambitions Beyond Gaming

AppLovin’s growth story is no longer tied to gaming. In fact, they’re taking clear steps to move beyond it:

Divested their entire games business

Building out self-serve infrastructure for small- and mid-size advertisers

Expanding into ecommerce, fintech, and other verticals

Eyeing Connected TV (CTV) through their Wurl acquisition

Most boldly: placed a bid for TikTok’s non-China operations in April 2025

This is a company that doesn’t want to be a niche ad network — it wants to compete with Google, Meta, and The Trade Desk.

Addressing Recent Short-Seller Reports

Recently, AppLovin has been the subject of scrutiny from several short-seller reports alleging questionable business practices. Notably:

Muddy Waters Research accused AppLovin of misappropriating user data and violating platform terms of service, suggesting the company could face deplatforming.

Fuzzy Panda Research and Culper Research also issued reports in late February 2025, alleging fraudulent and deceptive practices.

In response, AppLovin's CEO, Adam Foroughi, addressed these claims, stating that the company employs industry-standard practices in data collection and emphasizing their commitment to transparency and integrity.

Furthermore, AppLovin has retained the law firm Quinn Emanuel to conduct an independent review and investigation into the recent short-report activity.

Final Take

AppLovin is no longer a misunderstood mobile ad company. It’s a full-stack performance advertising platform with:

Proven operating leverage

One of the best AI ad engines in the market

Clear ambitions to expand far beyond its original niche (mobile gaming)

This is a stock that probably wants to stay above $100B — because the business underneath is starting to earn it.

So again, I’m not saying AppLovin is a buy here. Although I’ve taken a starter position, I’m still trying to fully understand how this business will evolve beyond mobile gaming.

It’s also unclear how well a digital advertising company like this would hold up during a recession, and I’m also not convinced that allocating nearly all of their free cash flow to share buybacks is the best long-term move. I’d like to see a few more quarters of performance and updated guidance to get a clearer picture of their cash flow trajectory beyond 2025.

Thank you for reading.

References:

Recommended post to get a full understanding of the business AppLovin -

https://www.morningstar.com/stocks/applovin-another-short-seller-report

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. All opinions are my own, and I am not a financial advisor. The information provided reflects my personal views and is intended to encourage discussion and thought among readers. Investments involve risk, including the loss of principal, and past performance is not indicative of future results. Always conduct your own research or consult with a qualified professional before making any financial decisions.