The seduction of Inference revenue growth and replacing human labor are still driving significant CapEx in AI from hyperscale companies like the Mag7. The sheer scale of these investments is too critical to ignore for investors. With Microsoft alone committing $80 billion to AI-enabled data centers, cash reserves have become almost a moot point compared to these astronomical spending levels.

If you’re a long-term investor in the Nasdaq100 (QQQ), you must form an opinion on AI’s ability to drive meaningful earnings growth. If you believe AI is overhyped and the spend won’t translate to substantial revenue and earnings growth, it would be tough to sleep at night while holding QQQ. The bet has already been made by the hyperscaler’s, and reversing these investments could devastate shareholder value.

This marks the dawn of a new technological era, much like the early days of the internet, iPhone, or cloud computing. Investments in next-gen nuclear reactors to power the AI rollout highlight the strategic and irreversible nature of these decisions. Nvidia and TSMC are at the forefront of this revolution, driving the technology that powers these developments. Nvidia's stock soared by 204% in 2024, while TSMC climbed 121%, far surpassing the PHLX Semiconductor Sector Index’s 35% gains. Nvidia’s inference revenue now makes up 50% of its total revenue and is likely to expand further.

The Rising Demand for AI Compute Power

The AI trend is fueled by “compute hogs” like advanced AI agents that demand vast resources. These agents go far beyond single-shot interactions like ChatGPT, requiring immense compute and energy to handle the billions of tokens and branches of inference they generate. Gartner, Inc. predicts global public cloud spending to grow 21.5% in 2025, further emphasizing that we’re only at the beginning of this compute-driven transformation.

Microsoft, Meta, Amazon, and Alphabet are projected to increase their combined CapEx on AI infrastructure from $200 billion in 2024 to $300 billion in 2025. This surge in spending underscores their commitment to AI, which has become the cornerstone of their growth strategies. Nvidia’s next-gen Blackwell processors and TSMC’s plan to double advanced chip packaging capacity position these companies to capitalize on this investment wave.

The diagram above shows a $31.8 billion or 37% year-over-year increase specifically to spending on compute and storage hardware infrastructure for AI deployments in the first half of 2024. Whereas, the total $300 billion estimate figure is the total projected AI infrastructure CapEx for Mag7 companies in 2025, which includes AI-related investments covering areas like cloud infrastructure, data centers, hardware, logistics, and other operational spending.

Potential Headwinds for AI-Mag7 Stocks

While the AI-driven growth story is compelling, it’s not without challenges. CapEx overspending, foreign exchange fluctuations, supply constraints, energy limitations, and high valuations could act as headwinds for these Mag7 companies. For Nvidia, export restrictions on certain chips to China further complicate the picture. However, if Nvidia continues its data center momentum, it could support the entire QQQ index due to its significant weighting.

Despite these risks, some of the top-performing stocks in 2024 were energy and utility companies powering AI infrastructure. Investors who want exposure to this trend without betting solely on an individual name might consider sector ETFs like XLU.

The Mag7’s AI Dominance

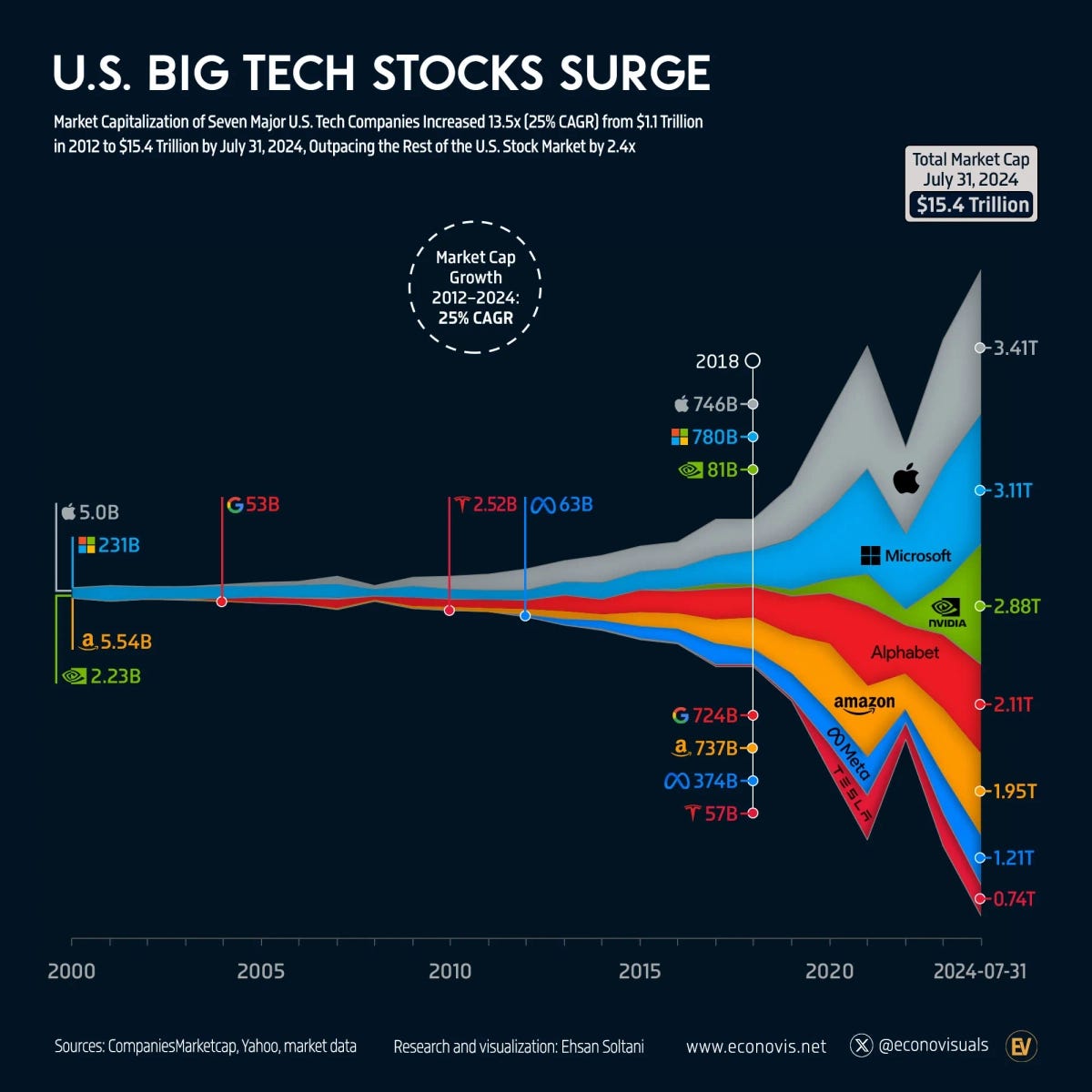

The Mag7 companies (Microsoft, Apple, Google, Amazon, Meta, Nvidia, and Tesla) are set to grow even more due to their dominance in AI. This evolution is reminiscent of previous revolutions, such as the internet and the cloud.

While their growth may not match the past decade’s pace, an AI industrial revolution could expand the U.S. economy itself, allowing these companies to maintain their relative size. This thesis, in my opinion, hinges on what Jensen Huang describes as the Physical AI and Robotics phase—where autonomous robots and advanced physical systems drive transformative GDP growth and reshape our daily lives in ways reminiscent of futuristic movies. In other words, you’re going to have a Megan Fox robot as your personal home maid and caretaker.

While value stocks still have a place in diversified portfolios, limiting exposure to the Mag7 could be a mistake. Letting winners run, even as they grow disproportionately large in your portfolio, is essential. Unlike the dot-com bubble, today’s Mag7 companies boast real revenue, earnings growth, and significant cash reserves to sustain their hyper-scaling efforts. Although their valuations are arguably high, they are far from the speculative extremes seen in the late 1990s.

Conclusion: Balancing Risk and Reward

The AI era is here, and it’s unclear whether the Mag7 hyperscaler’s are overspending on CapEx for a wishful dream or not. The Mag7 companies are in the best position to lead this charge because they have the cash to spend. If it seems crazy that these companies are so large and could continue growing even larger, I can tell you—be prepared.

While there are legitimate headwinds for 2025, it’s still an exciting time for long-term investors heavily allocated to the QQQ. Well, investing isn’t supposed to be exciting. I’m just saying: brace yourself for volatility in the coming years, but don’t be afraid to let your winners run. This could very well be the Golden Age of investing in tech.

References:

https://www.visualcapitalist.com/cp/charted-the-surging-value-of-magnificent-seven-2000-2024/

https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

https://www.idc.com/getdoc.jsp?containerId=prUS52758624

Disclaimer:

This blog is for informational purposes only and does not constitute financial advice. All opinions are my own, and I am not a financial advisor. The information provided reflects my personal views and is intended to encourage discussion and thought among readers. Investments involve risk, including the loss of principal, and past performance is not indicative of future results. Always conduct your own research or consult with a qualified professional before making any financial decisions.