I’ll be sharing my brief thoughts on what I like and don’t like about the latest Q4 13-F filings. However, please take with a grain of salt… I don’t claim to be as smart or as skilled at investing as these renowned legend’s. It’s also a massive mistake for retail investors to be overly concerned with what these investors are doing, as many of them are playing a very different game.

Retail investors can buy-and-hold positions in an accumulation phase to compound their portfolio for financial freedom one day. Many of these institutional investors have already achieved financial freedom through a select few trades or are managing portfolios with specific constraints. Their strategies might involve reducing volatility, focusing on dividends, hedging, or actively trading rather than long-term investing.

Please note that all 13-Fs filed with the SEC reflect holdings as of the end of Q4 2024, meaning this data can be backward-looking. To keep this post concise, I will only be covering the following portfolios today:

Berkshire Hathaway (Warren Buffett)

Pershing Square Capital Management (Bill Ackman)

Bill & Melinda Gates Foundation Trust

Appaloosa Management (David Tepper)

Tiger Global Management (Chase Coleman)

Depending on the engagement this post receives, I’ll use it as a gauge for future editions to determine whether I should expand coverage to include portfolios from investors like Leon Cooperman, Howard Marks, Terry Smith, Nelson Peltz, David Einhorn, Michael Burry, and others.

Berkshire Hathaway (Warren Buffett)

Yes, the headlines will be fixated on Buffett’s noticeable reduction in financial holdings, but what exactly do we define as “financials”? Perhaps the real headline should be that Buffett is moving away from big bank stocks instead. In reality, Bank of America still makes up 11% of his portfolio, and several of his top holdings—American Express, Visa, and Chubb—are very much financial companies.

The reason I like Berkshire’s holdings is because Apple is still king of the castle, with a holding of 28%. Most of his top holdings are winners, like American Express, Moody’s, Chubb, Visa, etc.

It’s the gas and oil stocks that I’m overall not a huge fan of, but I see their place in the portfolio for cash flows and dividends.

It seems we have a new position in Constellation Brands (STZ). Now we’re going to hear headlines that drinking alcohol is not dead, but I can tell you it’s really a nothing burger here. I would be very surprised if this ever became a big position for Berkshire, but I suppose one could see a Graham-style type of value in this cigar butt. I know Buffett is not really that type of investor anymore, but that’s what this position feels like to me.

Overall, Berkshire’s portfolio is solid. I’ve always been a fan of what they’ve built over the years, even though Buffett has taken criticism for holding some value traps like Kraft and airlines. I have to give him credit for Coca-Cola, which I once viewed as a potential value trap, but the business has proven to be a strong inflation hedge. They have successfully passed on price increases in a methodical way and were not shy about it. Maybe Berkshire saw this before me.

Pershing Square Capital Management - Bill Ackman

I'm not sure why, but it feels like we knew some of these moves were coming. Possibly Ackman himself mentioned some of these moves prior to the official 13-F in interviews? Either way, we have the reduction in Chipotle (CMG), which I believe he has been reducing for a few quarters. We have a significant add in Nike shares, which I believe he thinks is trading well below its intrinsic value.

I was saying I really don’t try and mirror most famous investors, but if there is anyone I have learned a lot from and take a good chunk of knowledge from, it’s Bill Ackman. His approach to value investing aligns closely with mine—not being afraid to own a business below its intrinsic value and even holding the business when it’s trading at a premium or considered over valued. The businesses he owns are very easy to understand and not complicated at all. He understands Google very well and is not afraid to buy and hold a big tech giant. He’s also got big balls to own a portfolio of only 10 stocks, which I could always do a better job of, as I have 5x as many positions.

With regards to Brookfield, I know a lot of famous investors like this business, and the stock has performed very well versus the S&P benchmark. I just don’t really understand the appeal, but I also haven’t done the homework on it like I have with Blackstone for example.

Bill & Melinda Gates Foundation Trust

The ultimate buy and hold portfolio! As you may know from reading prior posts, I’m big fan of this portfolio. Take your personal feelings out on who the man is behind the portfolio—whether it be Gates or Soros—this is not about the person, it’s about their portfolio. This portfolio has always kicked ass, and I also try and mirror most of his investing philosophy, which is to diversify into best-of-breed businesses and hold on to them for a very long time.

Really nothing noteworthy to report here. I don’t think the reduction in Berkshire is worth diving into. I love that there isn’t much movement here, which is a very healthy sign that he’s content with his portfolio and investing style.

Appaloosa Management - David Tepper

First off, I believe this 13-F was released a few weeks ago—I’m not sure why? So I just want to note that this may not be breaking news today.

Automatically, I’m never a big fan of famous investors going heavy in Chinese stocks, as I’m not a big fan of Chinese equities as an investment. That doesn’t mean that this time they’ll be right, but they have been wrong many times. So far, Chinese tech stocks have been ripping, and Tepper, to me, is more of a fund that is always trying to find cheap equities, ride them to a certain top, and sell. The fund never sits still—way too much movement typically.

Reducing US Big Tech and adding significantly more to his Chinese positions like BABA and JD.com feels like we’ve seen this too many times with the greats like Tepper or Burry, and it never comes to fruition. At the same time, while reducing large-cap US tech, we see Microsoft stay the same and a large add in Vistra Corp, which tells me he believes we’re going to need a lot more energy for the AI infrastructure rollout. That almost feels self-conflicting because a big chunk of that energy demand is going to come from CapEx spend in the same large-tech stocks he’s trimming hard.

There are also significant adds in semi’s like ASML, MU, LRCX, and even Nvidia. There’s definitely something that tells me he thinks the AI infrastructure boom is real, but the CapEx spend in these MAG7 stocks is going to catch up to them in a bad way. Or he’s simply just taking profits in these names and wants his cash to work more in the Chinese tech sector as a careful rotational trade. Either way, too many times have I seen him, or others, go all in on Chinese tech, and it never pan’s out in the long run.

Also, just a reminder—while DeepSeek AI has been around for a while and Tepper was likely aware of them, the real headline risk didn’t emerge until Q1. It’s important to keep in mind that a lot may have changed in Tepper’s thinking since the end of Q4.

If you’re wondering why I’m always a bear on Chinese stocks as an investment, this post may be worth a read:

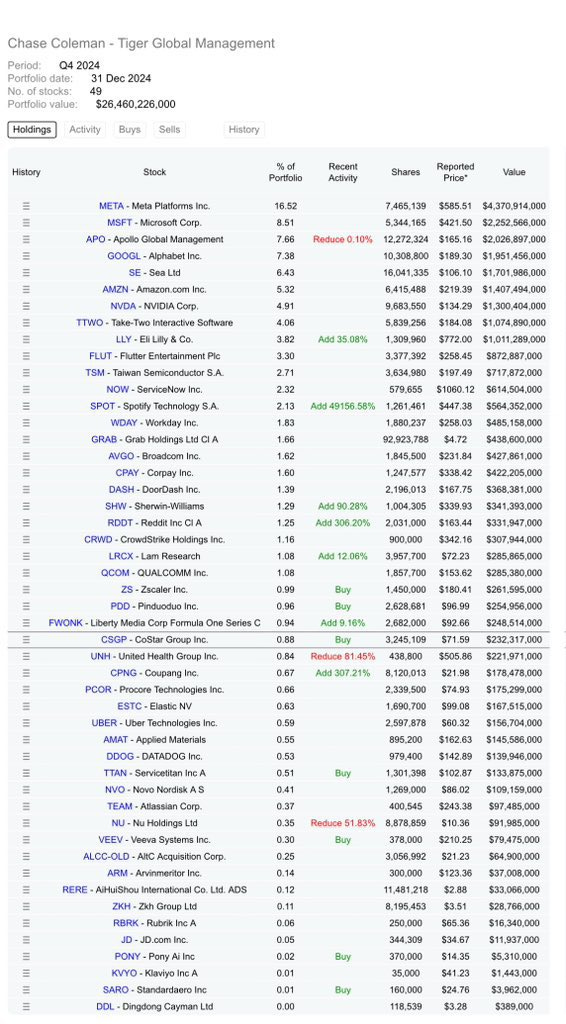

Tiger Global Management - Chase Coleman

Another investor that is right up my alley, with their long-term convictions in US tech, and a huge add in Spotify, which his timing was excellent based on the earnings we saw. What edge did he have on Spotify that I didn’t have? They have all the edge versus us retail investors, but we can still learn from the greats. In my opinion, Coleman has been the GOAT for a while, probably outperforming many of his peers.

Another key takeaway for retail investors—if you really like this portfolio, I’d suggest simply buying the Nasdaq 100 (QQQ). You can still add individual stocks around it, but using QQQ as your anchor or core strategy makes a lot of sense. This allows retail investors to go on with their lives while still competing with professionals who do this for a living.

The QQQ is a self-cleansing, market-cap-weighted index, meaning, like the S&P 500, you’ll naturally own more of the best-performing stocks over time. It adjusts itself, shedding weaker companies and allocating more weight to winners, making it a powerful long-term investment vehicle.

In Honor of 13-F Season: My Top 20 Holdings as of 2/16/25

With 13-F forms rolling in, I thought it would be a great time to share my own portfolio snapshot. Below are my top 20 holdings as of today.

Q4 2024 Moves:

Added to: IBIT, QQQ, WM, and MSTR

Sold entire positions in: CMG and TWLO

Trimmed: HIMS

Top 20 Holdings & Performance

NVDA – Total Gain: +2,971%, 15.3% of holdings

QQQ – Total Gain: +63.52%, 11.98% of holdings

DKNG – Total Gain: +38.4%, 9.26% of holdings

IBIT – Total Gain: +9.29%, 7.81% of holdings

MSTR – Total Gain: +18.16%, 6.99% of holdings

VTI – Total Gain: +48.74%, 4.78% of holdings

AMZN – Total Gain: +148.37%, 4.2% of holdings

AAPL – Total Gain: +500.87%, 4.04% of holdings

JPM – Total Gain: +162%, 2.65% of holdings

BRK.B – Total Gain: +141.14%, 2.42% of holdings

CAT – Total Gain: +159%, 2.03% of holdings

MSFT – Total Gain: +362%, 1.78% of holdings

CB – Total Gain: +55.39%, 1.65% of holdings

LMT – Total Gain: +45.45%, 1.59% of holdings

UNH – Total Gain: +116%, 1.54% of holdings

XLF – Total Gain: +48.63%, 1.47% of holdings

WM – Total Gain: +105.41%, 1.32% of holdings

XLU – Total Gain: +26.42%, 1.19% of holdings

RTX – Total Gain: +51.81%, 1.18% of holdings

SMH – Total Gain: +121.54%, 1.16% of holdings

That concludes today's post, and just a reminder—the stock market will be closed tomorrow, Monday, February 17th, in observance of President’s Day.

Please tell me you watched that USA vs. Canada hockey game last night. That might have been one of the most fun sporting events I’ve ever experienced from my couch—would have been unreal to be there in person.

And don’t forget to place your bets on DraftKings today. We’ve got the Daytona 500 and the final round of the PGA Genesis Invitational—plenty of action to get in on.

Also, in case you missed it, I recently sat down with

to talk markets, and stocks like Dutch Bros, DraftKings, and Tesla. Be sure to check it out below!USA Power Moves, Market Trends & Investment Plays: A Conversation with Bagholder

I had the pleasure of sitting down with Bagholder, a sharp mind on Substack who covers a broad range of topics, from investing in individual stocks and Bitcoin to philosophy and politics. If you’re not following his work, you should be. In this conversation, we covered a lot of ground, from US geopolitical strategy to stock market opportunities, and the video is…

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. All opinions are my own, and I am not a financial advisor. The information provided reflects my personal views and is intended to encourage discussion and thought among readers. Investments involve risk, including the loss of principal, and past performance is not indicative of future results. Always conduct your own research or consult with a qualified professional before making any financial decisions.

I may mention or disclose positions that I currently own in my portfolio. This is not a recommendation to buy, sell, or hold any securities. The positions shared are for entertainment purposes only and should not be considered financial advice. My portfolio reflects my personal investment strategy and risk tolerance, which may not align with yours. Always make investment decisions based on your own due diligence and consult a financial professional if needed.