I want to take a moment to clarify my newsletter from yesterday titled "Bearish Things Are Happening." By no means am I personally bearish, nor am I overly bullish. I never really have an opinion one way or the other, as I don't try to time the market. My point was simply that we may be witnessing a pendulum swing in the strength of the U.S. consumer and the AI hype cycle.

To put it another way, I don't know how quickly AI-driven productivity will start showing up in earnings and margins across the S&P 500. That doesn’t mean I’m bearish on AI per se—I think U.S. tech stocks remain a great long-term investment. I’m not worried about valuations being arguably high, I’m not worried about the MAG7 spending like drunken sailors, and I’m not concerned about their dominance in the major indexes.

The Power of Investing Amid Inflation

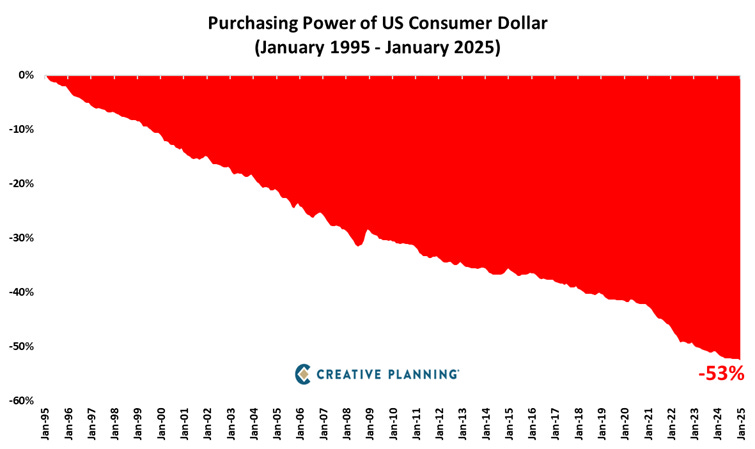

Now that we’ve cleared that up, I came across a tweet from Peter Mallouk on X that presents the purchasing power of the U.S. consumer dollar since 1995. Sure, this isn’t an exact science, and if anything, the dollar may have lost more than the 53% presented in the chart.

When talking to friends and family who are somewhat interested in investing but haven’t started, this is the kind of chart I would show them. If someone is stalling or procrastinating on investing, this is what I’d use to get them moving. If they ask whether they should invest in Gold or Bitcoin, this chart would be relevant too.

Most people who don’t follow markets closely understand that they should invest in index funds as an inflation hedge. This type of chart helps reinforce that idea. Of course, other assets—like gold, Bitcoin, and real estate—can also serve as inflation hedges, depending on one's strategy.

Who I wouldn’t show this chart to is Warren Buffett. He doesn’t give a shit, he’s perfectly content right now earning around 4.5% in short-term Treasuries, that’s where most of Berkshire’s massive $335 billion cash pile is currently parked. I personally think it’s kind of badass. People praise cyrpto stablecoins like Tether for being “cash monsters” when they do the same thing, yet when Buffett does it, many claim he’s just letting his cash wither away. I by no means think 4.5% yields is something to proud of, but for Berkshire, I give him a pass. He’s got every right to make this kind of yield on his cash pile.

Market Themes and My Current Stance

The theme today, and I assume for much of the day, was cash-rich value companies versus riskier, more growth-oriented stocks—what Michael Santoli refers to as defensive stocks. We saw continued selling in tech and momentum-driven growth names.

Unfortunately, since starting this blog a few months ago, there haven’t been many urgent buying opportunities, and today is no different. I have no urgency to buy PLTR, CAVA, or APP. If we see a bounce from here, I’ll have no problem sleeping at night knowing I missed these dips.

That said, I do have an itch to buy more AMZN at these levels. I think the stock is at a good price today. But I also know there will come a time when the QQQ corrects 10%, and it will feel like the world is ending—that’s when I’ll be happy to scoop up more AMZN. So again, I can be patient.

If I didn’t already have exposure to Bitcoin, I’d still be saying the same thing I’ve been saying for a while now: I like Bitcoin trading below $100K. That doesn’t mean Bitcoin can’t drop further, but for those looking to buy and hold long-term, I believe we’re in a healthy trading range, and $100K will likely serve as a new psychological support level.

For those looking for international exposure, I wouldn’t hesitate to deploy capital into select countries that you’ve studied and believe in. My favorite international ETF remains the The Freedom 100 Emerging Markets ETF (FRDM), and I wouldn’t be opposed to allocating here. Again, this is if you’re itching to get international exposure.

Speculative Thoughts and Watchlist Updates

99% of my positions are long-term, but on a speculative level, I’d bet that any dip below $50 in Chipotle (CMG) won’t last long. That could make for an interesting swing trade or a long-term buy. I don’t love that Bill Ackman is selling so much of his position in the stock, and CMG certainly isn’t the cheapest name out there. But if you’re comfortable owning it long-term and holding through volatility, I wouldn’t advise looking at CMG purely as a trade.

Other stocks I wish I had bought at cheaper valuations—SPOT, BROS, BRO, TDG—are still on my watchlist alongside APP and PLTR, but I’m staying away for now since I don’t consider them bargains. I do own a position in CAVA, and I wouldn’t mind adding if I felt it was on sale.

As for The Trade Desk (TTD), it’s not currently on my watchlist because I haven’t done enough research on the business. Even after its significant sell-off, I still think it’s expensive. But I am intrigued by it. It seems to have a moat of some kind that I haven’t fully wrapped my head around yet.

That’s the same reason I should probably reevaluate whether APP belongs on my watchlist—I need to do more research before pulling the trigger. Understanding a business and its niche industry takes time, and I don’t rush into investments without conviction.

Wrapping Up

Thank you for reading, and please have a great evening. Enjoy earnings tonight, and good luck to HIMS investors.

In case you missed it:

Bearish Things Are Happening

During this morning's Investing or Gambling podcast, hosts Illiana Mike and George from South Florida both agreed they’re starting to see cracks in the economy, with signs that the U.S. consumer may be losing steam. Credit card delinquencies continue to rise*, and after a strong Q4 spending period, inflation could finally be taking its toll.

Berkshire Hathaway 2024 Annual Report: The Fun Stuff Only

I hope everyone is enjoying their weekend after that bloodbath of a Friday in the markets. If you’re looking for some positive news to counterbalance the frustration we had last week, Warren Buffett is here once again to play the role of investing’s steady hand—reassuring us, as he always does, that owning great American businesses for the long run rema…

Hyper Growth Stocks Take a Breather: Rigatoni Capital State of the Union Rant:

Today is a good reminder to tell you all that I was right... well, I'm half joking. But my main theme has been:

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. All opinions are my own, and I am not a financial advisor. The information provided reflects my personal views and is intended to encourage discussion and thought among readers. Investments involve risk, including the loss of principal, and past performance is not indicative of future results. Always conduct your own research or consult with a qualified professional before making any financial decisions.