Market Rotation, Bitcoin Crash, & Nvidia Earnings

$QQQ nearing a 10% correction – a break of $500 support could trigger further selling. Also $NVDA earnings and Bitcoin's crash.

For us to break through $500 in the Nasdaq100 (QQQ) and get close to a 10% correction near $485 per share, it would be impossible to determine why we would see this type of drawdown.

Yes, a sharp sell-off in Nvidia could be a key catalyst for a broader correction in this index.

Or, it could be an economic growth slowdown or tariff fears.

Or, it could be an unexpected event that no one has on their bingo card.

Or it could be nothing but uncertainty and profit taking.

It could be an array of things, and it's not worth trying to guess or listen to any genie that claims to see the future.

All I can say is that when or if it does happen, don’t be surprised how fast it happens. We’re very close after today’s close.

We’ve been trading in a very orderly range between $500 and $540 since the November election. A break in $500 support could cause a lot of traders to adjust positions until we catch a new support.

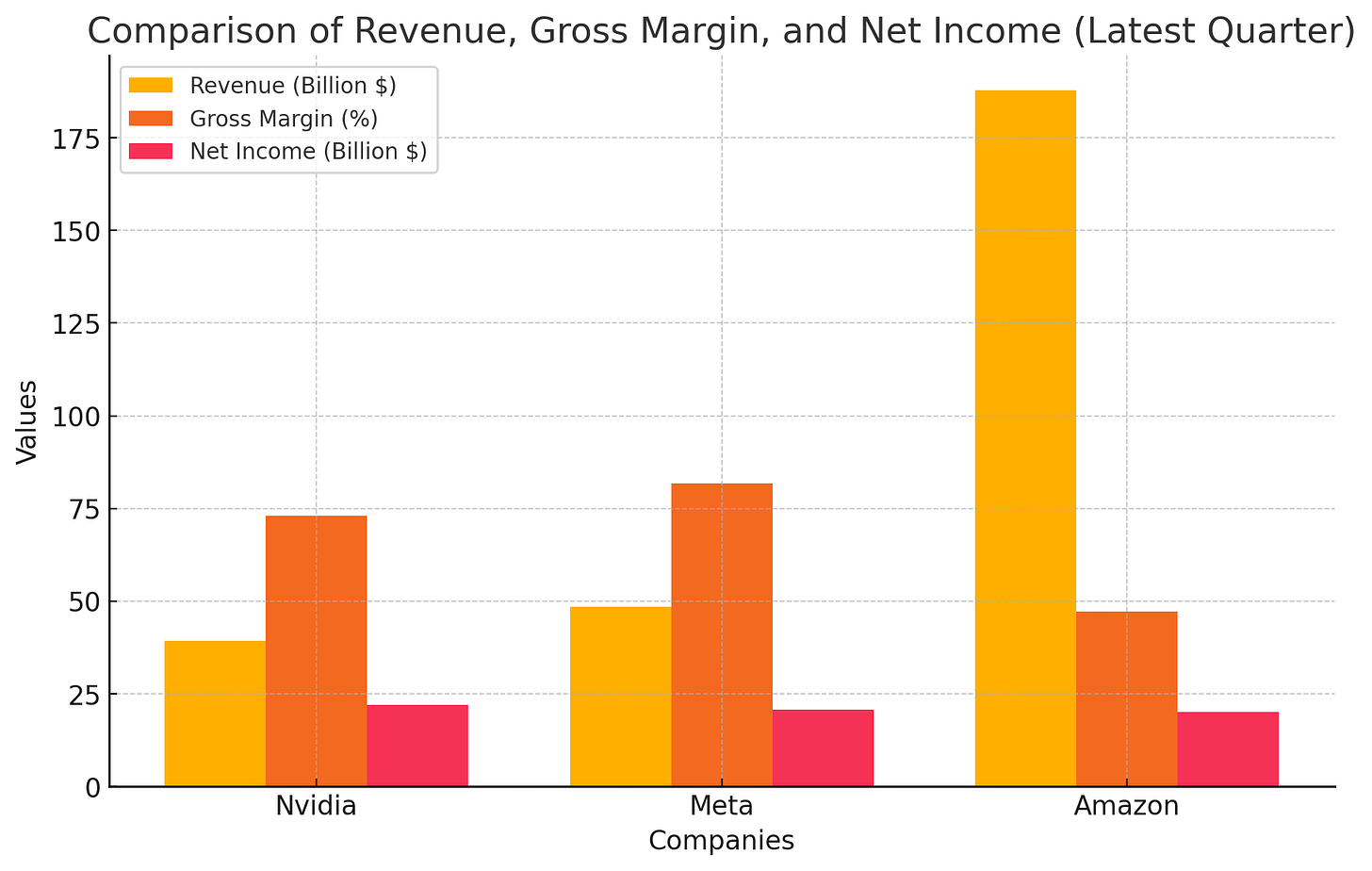

Meanwhile, it seems like Jensen Huang during the Nvidia earnings call is slowly putting the DeepSeek AI worries to bed, and Nvidia had a strong earnings report, resolving some of their Blackwell supply constraints while keeping margins in a healthy range. This was the grand finale of Q4 2024 earnings, and we got through earnings season safely. Personally, I'm very pleased with the MAG7 and Tech earnings overall.

I think the most important thing to note is that Nvidia is now generating as much net income in one quarter as Amazon and Meta. To claim the stock is in a bubble or the next Cisco feels pretty off base at this point.

Is Nvidia still expensive at 29x? I think there is a fair argument by both sides. But ultimately, you’re paying for growth, and a company delivering growth at this level deserves a premium.

I’ve seen headlines that the 78% revenue year-over-year increase is not sustainable. Well, don’t we already know that a company like Nvidia can’t grow this fast forever, or that’s it’s unlikely? Data Center Revenue can still see nice growth over many years, but it’s obvious you’re not going to see a 100% growth rate each year. My point is that the market “already” understands this. This is already built into the price. Don’t let people tell you otherwise.

With a rapidly growing cash reserve, Nvidia investors will need to trust management’s ability to deploy capital strategically—whether through scaling operations, investing in R&D, pursuing acquisitions (M&A), executing share buybacks at the right time, or other growth initiatives to sustain the company’s momentum.

Rotation Out of Retail Favorites & Bitcoin

This potential theme playing out in the markets—popular "retail" stocks are getting whacked, led by the momentum-growth names kind of makes sense as time goes by. We’re seeing a rotation out of Bitcoin (BTC), MicroStrategy (MSTR), and crypto while at the same time witnessing drawdowns in other AI-themed names like VST, CEG, TSM, and NVDA. The common theme is these are all popular names amongst retail investors.

If this is indeed true, and institutional investors are not as exposed to these names or not selling during this drawdown, I think it’s worth investigating. I’m not convinced “Institutional” is dumping, and retail is panicking afterwards. I think it’s quite possible the pump and dump were both driven by retail.

If there’s a rotation into value-oriented, quality names, that seems quite possible. But no one can predict how long this rotation will last and if it’s even real. No reason to predict in my opinion. It’s only been a few weeks, and rotations like this are confirmed after weeks, sometimes months.

Let’s touch on Bitcoin briefly… since I am getting texts about the sell-off today. We’re seeing some follow-through on outflows in Bitcoin ETF’s, totaling over $1.1billion in a single day. In my opinion, retail is forcing the hands of institutional investors to take profit in Bitcoin, meaning it’s retail that’s driving this sentiment more than anything else.

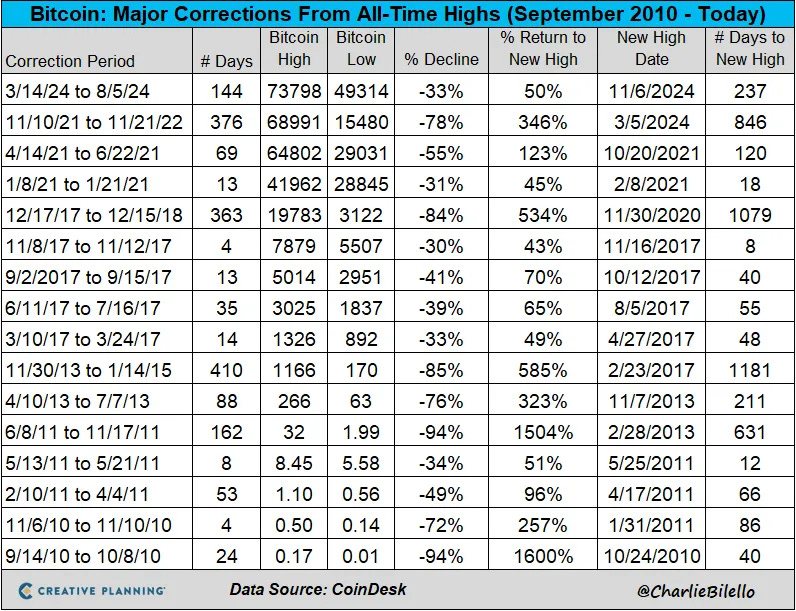

Any headlines or market predictors suggesting we could see support levels or declines towards $70,000 are just noise. Sure, it’s possible, and it wouldn’t be the end of the world unless you’re levered up like crazy. But Bitcoin is going to shake out weak hands more than any other asset, and that’s completely healthy—a feature of Bitcoin, not a bug.

I’ve shared this before, but I’ll share it again. Charlie Bilello at Creative Planning tweeted an image on X showing all major corrections in Bitcoin since 2010.

Sorry to say, but if you’re uncomfortable with this drawdown from the highs, you better build some thicker skin—fast.

A Healthy Shakeout for Growth Stocks

As long-term investors, I think we can all agree these types of sell-offs in “expensive” growth stocks are extremely healthy. The hyperbolic moves we saw in more "retail favorite" names were unsustainable.

The growth-momentum trade was insane, fun, and exciting, and some of it was even valid because some of these businesses are starting to perform financially. In other words, we’re starting to see them grow up and mature. But it was still too unhealthy to see those types of gains in such a short period of time.

As I’ve said over and over, it felt like a very crowded trade just a few weeks ago before the pop occurred.

Researching Growth Names

Over the next few months, I’ll try to better understand these businesses, research them, and share anything I find worth noting.

I’ll admit that before this pump and dump, I had not been researching some of these growth stocks that now pique my interest, including:

TTD (The Trade Desk)

APP (AppLovin)

PLTR (Palantir)

Spotify (SPOT) hasn’t pulled back much, but I’m intrigued to study the business more.

I’ve owned CAVA since April 2024, and it will always be on my radar.

Dutch Bros (BROS) is also intriguing, but I need to do a lot more research before forming an opinion.

Even Robinhood (HOOD)—which I completely dismissed after 2021 as a poorly managed business, seems to have turned things around and matured into a more competent operation.

My Investing Approach & Watchlist

My primary goal remains adding to the QQQ during a drawdown or “significant drawdowns.” There’s not much research needed on QQQ as an index, which allows me to focus my research on these other growth stocks as well as value-oriented names on my watchlist, such as:

BRO (Brown & Brown)

TDG (TransDigm Group)

CB (Chubb), WM (Waste Management), AMZN (Amazon) (These are stocks I already own but will always monitor.)

Final Thoughts

Anyway, I’m under the weather once again, but despite that, I’m excited bout what’s happening in the markets. If this is a real market sell-off or rotation, no one knows.

My suggestion is to be patient and there will be plenty of times to be contrarian and buy assets at better prices than today.

We’re going to see lots of headlines about tariffs from today through the weekend. I’m sure many traders understand the 4pm Trump rule, where we get a big chunk of these spooky headlines after market close. Most traders don’t want to be in long positions overnight or over the weekend that are trading around these type of headlines.

That said, no tariff or political headlines are impacting the way I invest personally, and I suggest you do the same.

As always, I’ll continue studying these businesses and sharing anything I find worth noting. Thanks, and have a great night!

P.S. Don’t trade Bitcoin, own it.

In case you missed:

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. All opinions are my own, and I am not a financial advisor. The information provided reflects my personal views and is intended to encourage discussion and thought among readers. Investments involve risk, including the loss of principal, and past performance is not indicative of future results. Always conduct your own research or consult with a qualified professional before making any financial decisions.