VanEck Semiconductor ETF (SMH)

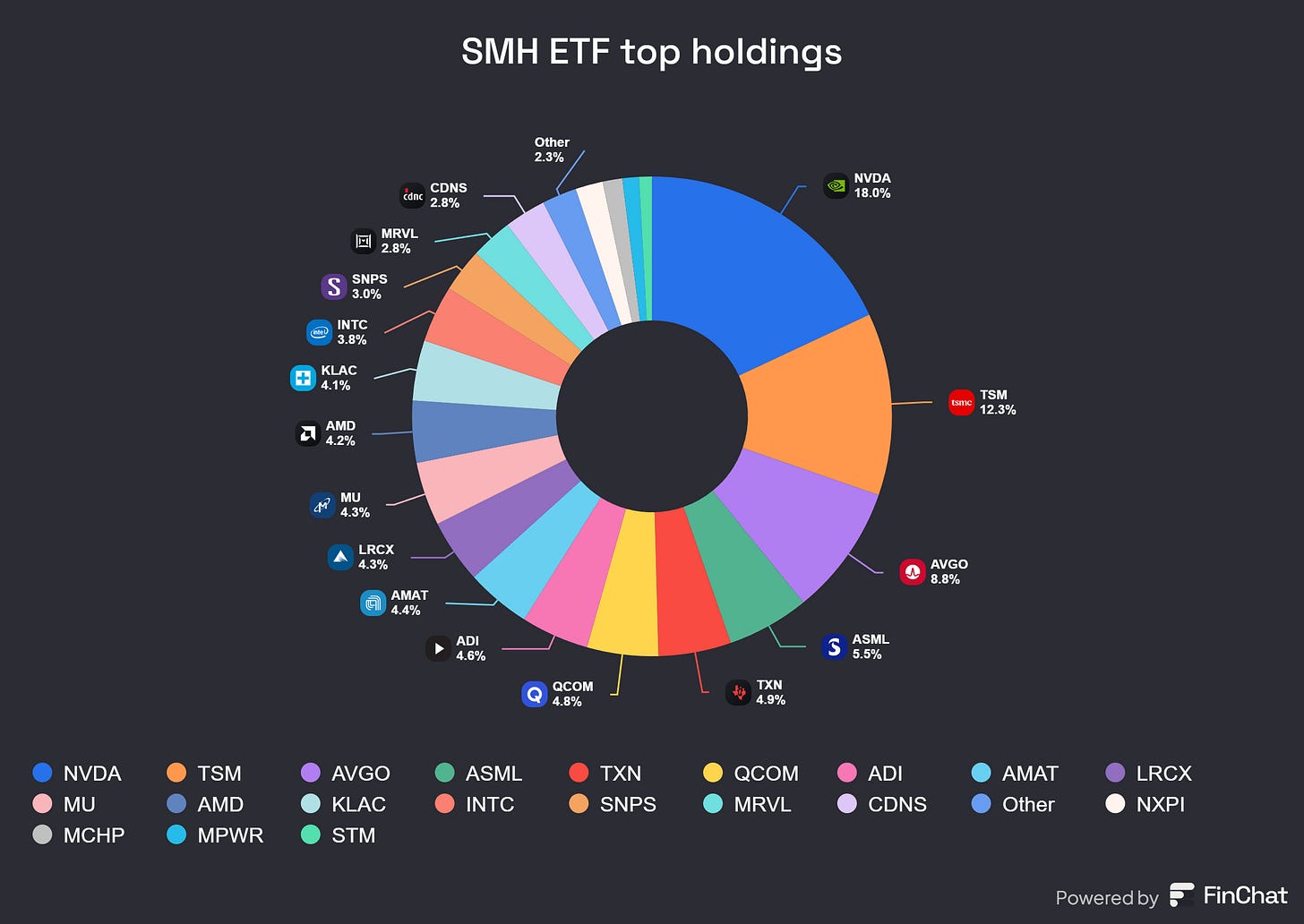

The VanEck Semiconductor ETF (SMH) is one of the most widely followed ETFs for semiconductor exposure. It tracks a market-cap-weighted index of 25 of the largest U.S.-listed semiconductor companies, following the MVIS US Listed Semiconductor 25 NR USD Index.

Key Fund Stats:

Top 10 Holdings: 71.77% of total assets

Assets Under Management (AUM): $20.81 billion

Trailing P/E Ratio: 43.99

30-Day Yield: 0.53%

Expense Ratio: 0.35%

SMH is highly concentrated in a handful of names, meaning its performance is largely dictated by its biggest holdings—including Nvidia (NVDA), Taiwan Semiconductor (TSM), Broadcom (AVGO), and ASML (ASML).

Why I’m Not Buying More Semiconductors Right Now

It has been a very long time since Rigatoni Capital has purchased stocks, as the last big buys were around August 5th, 2024 during the Japan Carry Trade unwind. Since then, there have been no big purchases until Friday, March 7th, when the Nasdaq 100 (QQQ) was selling in 10-11% correction territory.

I did buy some QQQ and individual tech stocks on Friday, but I steered away from purchasing semiconductor stocks at this time.

And no, it’s not because we saw an SMH death cross (200 SMA overlapping the 50 SMA). While that can be an important indicator, I usually don’t abide by these technical indicators.

For me, it’s a combination of factors:

Nvidia is still my largest holding, after losing up to $1T of value during its drawdown.

I already have exposure to semiconductors through QQQ, SMH, and individual names like Lam Research (LRCX)—all at a fairly low cost basis.

Am I rushing in to buy more? No, because the headwinds still seem valid to me.

If you’re bullish on the AI theme, you can still be cautious with semis, as the rotation from AI hardware chips to software-driven AI names is a natural shift in capital allocation.

This is why QQQ seems like a better bet today vs SMH.

Semiconductors: A Cyclical Industry With Question Marks

We saw Nvidia go on an absolute tear after ChatGPT’s release and coming off the 2022 bear market. At one point, the SMH ETF was in a 50% drawdown in 2022, which gave it a low base to move up from. But like most semiconductor cycles, there’s always a slowdown period or consolidation that follows the boom.

With a potential growth slowdown ahead, this index could sit in the gutter for a while as we work through:

New Trump export regulations & tariff hurdles

AI infrastructure spending cycles (although MAG7 is still forecasted to spend $300b on AI CapEx in 2025)

Understanding if the AI Software Rotation is where capital is flowing now.

I think we need to realize that since Nvidia and SMH have cooled down, the rotation was clearly into software names that invested in AI. The sentiment from media and institutional investors was that software would be the next AI rotation after AI hardware. Of course, this was before we had a pullback in all tech names.

SMH ETF: Heavy Concentration in a Few Names

If you want to analyze SMH, you don’t need to look at all 25 holdings—because the ETF is highly concentrated in just a few names.

Top Holdings (~45% of the ETF):

NVIDIA (NVDA)

Taiwan Semiconductor (TSM)

Broadcom (AVGO)

ASML (ASML)

These four stocks alone drive nearly half of the ETF’s movement, so if you’re trying to gauge where SMH is headed, you could save sometime just diving into these few names.

One thing to note* If Nvidia gets too large of a weighting (over 20-25%), the fund “could” automatically rebalance by selling half of its position. This is very common with sector ETFs due to regulatory rebalancing rules. It can disappoint some investors that believe they are investing in a true “market cap weighted” index.

What About Valuation?

We can ballpark the semiconductor sector’s forward P/E, but let’s look at these top-weighted names to play fair:

As of Friday, March 7th 2025:

Nvidia (NVDA) – Forward P/E: ~25

Taiwan Semiconductor (TSM) – Forward P/E: ~19-20

Broadcom (AVGO) – Forward P/E: ~28-30

The reason I point this out is when looking at an index’s forward multiple average, like SMH or QQQ, a few outliers with extremely high valuations can skew the avg higher, making it look more expensive than it actually is.

2025 guidance for most of these top holdings appear slightly optimistic, with flat to modest growth across the board. Of course, companies like Intel (INTC) and Micron (MU) continue to disappoint and face tremendous challenges while dwindling down their weight within the index (making them less important).

The Geopolitical Case for Semiconductors & Why Timing Still Matters

We’ve heard the comparisons plenty of times before—big data is the new oil. More recently, semiconductors have been called the new oil, given their critical role in everything from AI to national security.

The SMH index still outperforms the Nasdaq 100 and S&P 500 in many time-frames.

If we’re going to keep innovating and creating new demand for semiconductors, GPUs, or whatever chips become in high demand next, we need to have a long-term perspective.

Having some exposure to SMH makes sense as a long-term market trend.

At the same time, we need to be conscious of the industry’s cyclicality. No matter what Nvidia says or does, the sector still has inherent boom-and-bust cycles although the longer-term trend has been bottom left to upper right.

It still can be argued we’re in a boom cycle, by looking at January YoY global chip sales, up 17.9%.

One way to anticipate the cyclicality of semi-chips (which I don’t recommend), is by tracking the largest end-market users. Right now, data centers, PCs, and computer storage are the primary drivers lifting the sector (thanks to AI). However, it’s important to note that as of 2023, communications and smartphones still accounted for 32% of the semiconductor market usage.

A weaker-than-expected iPhone or Samsung upgrade cycle are supposed to have a meaningful impact on SMH’s performance. With a lot of knee-jerk headlines over the years, I would take it all with a grain of salt when you see these. It’s true that AI-driven investments could offset a slowdown in the smartphone market.

Regulatory Headwinds: Tighter Export Restrictions & Geopolitical Risk

One of the biggest risks to semiconductors right now is increasingly strict export controls. The U.S. is limiting advanced chip sales to China in an effort to curb military applications and maintain technological superiority. Whether you agree with these policies or not, the reality is that these restrictions are expected to become even stricter under Trump’s second term.

The CHIPS Act: Not a Game-Changer for SMH

It’s unclear whether the CHIPS Act will be renegotiated, but in my view, it was never a real reason to buy the semiconductor sector in the first place.

Trump has openly criticized the CHIPS Act, arguing that the $50 billion in federal incentives amounted to nothing more than a handout. Instead, he has suggested that tariffs would be a better way to bring semiconductor manufacturing back to the U.S.

I’m not interested in debating whether the CHIPS Act was good or bad policy—but from an investment standpoint, I don’t think it will meaningfully impact the holdings of SMH either way.

What I do believe is that government interference in trade regulations and incentive programs often does more harm than good. The semiconductor industry thrives when businesses operate freely, rather than being subjected to political influence.

That said, there is merit in diversifying away from a single dominant manufacturer like Taiwan Semiconductor (TSMC), which currently makes the U.S. vulnerable in several ways. However, finding the right balance between reducing reliance on TSMC and avoiding excessive government intervention is a challenge the market will have to navigate.

Final Thoughts

I’m a little skeptical about diving headfirst into SMH or individual semi names. AI is definitely cyclical within a cycle—we saw:

Capital flow in AI hardware (Nvidia, SMH) (2023 thru 2024).

Then a consolidation and rotation into software names (late 2024 into 2025)

This tells me that AI capital flows rotate within sectors, which is why having exposure to QQQ makes more sense as a growth ETF. You still get Nvidia, Broadcom, and other semiconductor names—without being tied to just one sector.

Yes, I think having exposure to SMH and specific semiconductor stocks is wise. But due to the sectors cyclicality and volatility, you can just opt out for the Nasdaq 100 for the time being.

Thank you for reading, and please subscribe for more thoughts on long-term investing.

References:

In case you missed:

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. All opinions are my own, and I am not a financial advisor. The information provided reflects my personal views and is intended to encourage discussion and thought among readers. Investments involve risk, including the loss of principal, and past performance is not indicative of future results. Always conduct your own research or consult with a qualified professional before making any financial decisions.